Making the $10 trillion+ repo market safer and more efficient through the Broadridge Distributed Ledger Repo (DLR) solution

The challenge: Reduce the risk and cost of a systemically important market

The repo markets are the workhorse of finance, underpinning the smooth functioning of capital markets by providing essential financing and liquidity to global corporations and local municipalities. Repo transactions are open-ended, complex multi-party transactions with daily lifecycle events. Every participating institution has different needs, creating a wealth of functionality requirements across the different systems used to process and manage transactions.

Although markets are safer following financial reforms, repo remains full of operationally intensive, customized processes. Manual reconciliation and intervention result in significant operational overhead and capital utilization due to asynchronous cash and securities settlement. With no single source of truth for the lifecycle of the trade, fragmentation, fails, and disputes are common and costly. As an example, as of April 2023, treasury fails over the prior 12 months averaged approximately $40 billion per day and resulted in millions of dollars in daily penalties for market partIcipants.

Horacio Barakat

Head of Digital Innovation, Capital Markets

“A fully automated end-to-end repo service supports the simultaneous settlement of cash and securities, removing risk from the process and significantly decreasing capital costs. Momentum and interest in the platform continue to grow.”

Want to learn how Digital Asset can transform your business?

The solution: Agree, execute, and settle repo transactions on a single ledger available to all participants

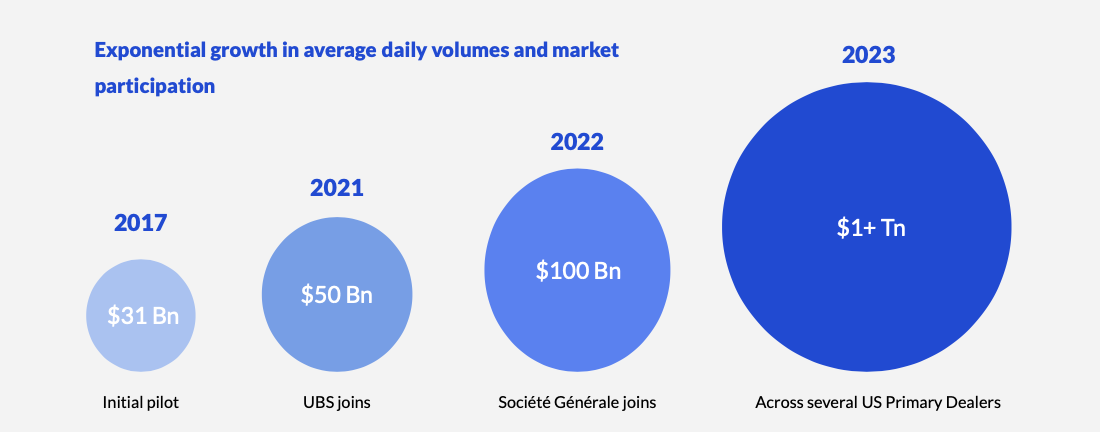

Broadridge processes repo transactions for 20 of the 24 primary dealers in the US. They tackled the challenge head on, creating Distributed Ledger Repo (DLR) and providing a single platform where market participants agree, execute and settle repo transactions.

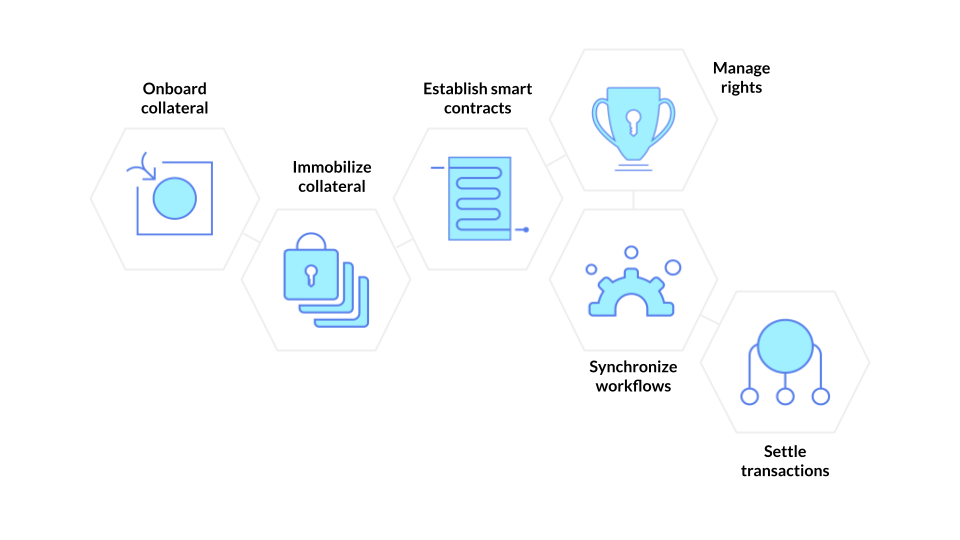

Using a digital repo approach, collateral can be detached from the trade agreement while the cash remains off chain. The underlying securities in the repo transaction can be immobilized while ownership is transferred via smart contracts. Participants gain a synchronized, mutualized workflow with access to one real-time, always accurate source of data.

Easily integrated, scalable solution transforms a critical market

DLR uses distributed ledger technology to model the repo process and associated lifecycle events across sellers and buyers from repo creation to maturity. Using Digital Asset’s Daml:

-

Market and processing rules are embedded, so every step can be validated, proved, observable and auditable.

-

The legal terms of every agreement are encoded and preserved. Roles, rights, and obligations of all parties are clearly identified.

-

Privacy and data segregation are built in and managed through deep integration.

-

Settlement takes place simultaneously, improving mobility and removing risk. Secured parties remain secured.

While the first use cases focused on bilateral repos and intracompany transfers/collateral movement, DLR is agnostic to geography and type of security. It will ultimately support a wide array of transaction types across jurisdictions, including intraday, overnight, evergreen and term repos on a bilateral and intracompany basis, and is scalable to handle increasing volumes.

Widespread adoption creates a network effect that extends benefits

more broadly throughout the repo ecosystem

New alpha and lower capital costs

Transaction execution costs dramatically decrease. More strategic collateral deployment lessens capital charges.

Substantially reduced risk

Workflows are synchronized and mutualized, with a single, real-time source of data available to all participants. Underlying securities can be immobilized with ownership transferred.

Enhanced efficiency

Manual processes and reconciliations are eliminated. Settlement timings and market delivery fails are reduced.

Designed for scale and easy adoption

Works with existing depositories, payment rails and participants’ underlying technology.

Outcomes

With DLR, the buy and sell side realize tangible benefits from better performance, greater efficiency, lower costs and more security. Broker dealers save ~25-50 bps of premium by not having to borrow from internal treasury and avoid 100+ bps penalties for late-day borrowing. Settlement certainty nearly eliminates overdraft fees caused by failed settlements, which can exceed ~300 bps. Capital charges based on internal borrowing and daylight overdraft costs also decline, while collateral is optimized to meet required value without overcollateralization, resulting in an average ~25% clearing cost reduction for clients.

As more market participants join, the benefits of improved liquidity, effective collateral utilization, and substantially reduced counterparty and settlement risk extend even further to drive efficiency throughout the post-trade lifecycle.

Broadridge Financial Solutions, Inc. (NYSE: BR) is a global Fintech leader with more than $5 billion in revenues, provides the critical infrastructure that powers investing, corporate governance and communications to enable better financial lives. Broadridge delivers technology-driven solutions that drive digital transformation for clients and help them get ahead of today’s challenges to capitalize on what’s next.

Want to learn how

Digital Asset can transform

your business?

One of our specialists will be in touch to give you a firsthand look at what Daml can do.